NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

FOR IMMEDIATE RELEASE

23 May 2024

Tate & Lyle PLC

(“Tate & Lyle”)

Sale of the remaining interest in Primient joint venture to KPS Capital Partners, LP for US$350m (c.£279m)

Completes Tate & Lyle’s transformation to a growth-focused speciality business

Proceeds from sale to be returned to shareholders through a share buyback programme

Over the last six years, Tate & Lyle has been executing a major strategic transformation to become a growth-focused speciality food and beverage solutions business. This transformation has included a much sharper focus on customers and categories, increased investments in innovation and solution selling capabilities, and significantly strengthening our sweetening, mouthfeel and fortification platforms through new product development and acquisitions.

A critical step in this journey was the sale, in April 2022, of a controlling interest in Primient, our primary products business in North America and Latin America, to KPS Capital Partners, LP ("KPS”). Today we are announcing an agreement to sell our remaining 49.7% interest in Primary Products Investments LLC (“Primient”) to KPS (the “Transaction”).

Transaction highlights:

- Tate & Lyle will receive cash proceeds of US$350 million (c.£279 million). Net cash proceeds, after tax and transactions costs, are expected to be around US$270 million (c.£215 million).

- The Transaction values Tate & Lyle’s 49.7% stake in Primient at 6.5x EV/EBITDA (year ended 31 March 2024), ahead of the valuation of Primient on the sale of the initial controlling stake, completed on 1 April 2022 (5.1x EV/EBITDA (year ended 31 March 2021)).

- Robust long-term agreements put in place with Primient in April 2022 to ensure supply security, with a remaining life of around 18 years, will continue to operate following the Transaction.

- Total cash proceeds from the full exit of Primient, including dividends received since the sale of the initial holding in April 2022, exceed US$1.5 billion.

The Transaction completes the staged exit from Primient well ahead of expiry of the original lock-up period of eight years which lasts until 1 April 2030. It also simplifies the business and fully focuses Tate & Lyle as a global, growth-focused speciality food and beverage solutions business, aligned to attractive structural and growing consumer trends for healthier, better tasting food and drink.

The Transaction proceeds will be payable in cash at completion which is anticipated by the end of July 2024.

Use of proceeds:

Consistent with the Board’s clear capital allocation policy and the strength of the Tate & Lyle balance sheet, the Board intends to return the net cash proceeds received from this Transaction (expected to be around US$270 million (c.£215 million)) to shareholders by way of an on-market share buyback programme. The buyback is expected to commence on completion of the Transaction.

Commenting on the sale, Nick Hampton, Chief Executive said:

“I am delighted that we have reached agreement with KPS for the sale of our remaining stake in Primient well ahead of the original lock-up period. This is testament to the relationships we have built with KPS and Primient, and the robust framework for the separation of Primient established two years ago. With this sale, the transformation of Tate & Lyle into a fully-focused speciality food and beverage solutions business is complete. We are now well-positioned to capture the significant growth opportunities ahead as we look to provide our customers with the solutions they need to meet growing consumer demand for healthier, tastier and more sustainable food and drink.”

Michael Psaros, Co-Founder and Managing Partner of KPS Capital Partners, said:

“We are thrilled to acquire Tate & Lyle's ownership interest in Primient and, upon completion of the purchase, KPS will be sole-owner of the company. Primient’s performance has exceeded our expectations, and we are very confident in its future. We thank Tate & Lyle for its constructive partnership with KPS over the past two years. Primient looks forward to continuing its positive relationship with Tate & Lyle as a supplier under the long-term supply agreements.”

Further details (including the pro-forma effect of the Transaction on Tate & Lyle) are set out in the Notes below.

Enquiries:

For more information contact Tate & Lyle PLC:

Christopher Marsh, VP, Investor Relations

Mobile: +44 (0)7796 192 688

Nick Hasell (FTI Consulting), Media Relations

Mobile: +44 (0)7825 523 383

Notes:

1. The Transaction constitutes a Class 2 transaction for Tate & Lyle under the UK Listing Rules. The gross assets that are the subject of this Transaction amounted to US$209m (£165m) at 31 March 2024. These assets generated a reported profit before tax (at share) for the financial year ended 31 March 2024 of US$32m (£25m).

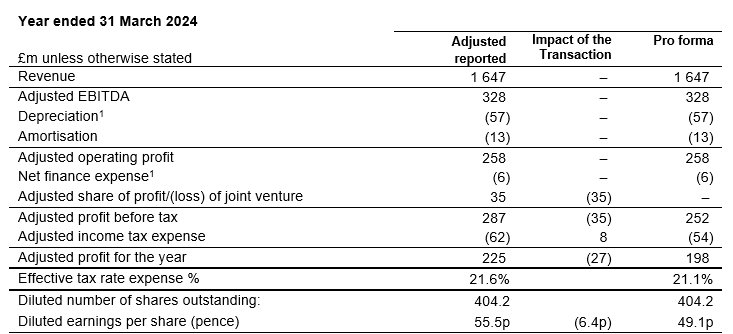

2. PRO-FORMA RESTATEMENT OF PRIOR YEAR FINANCIAL INFORMATION FOR THE SALE OF THE REMAINING INTEREST IN THE PRIMIENT JOINT VENTURE

To assist with understanding the impact of the Transaction, set out below is pro-forma financial information for Tate & Lyle for the financial year ended 31 March 2024. The pro-forma financial information is designed to show the illustrative impact of the Transaction on continuing operations of Tate & Lyle as if it had completed on 1 April 2023, being the start of the period presented. The pro-forma adjustments show a reduction in adjusted diluted earnings per share for each period.

The Transaction has been treated as a non-adjusting post balance sheet event in the results for the financial year ended 31 March 2024, also announced on 23 May 2024. As a result, the Transaction has given rise to no change in Tate & Lyle’s accounting for Primient or of its presentation in the Tate & Lyle financial statements for the financial year ended 31 March 2024.

1. No pro forma adjustment for interest income generated from the proceeds has been made as it has been assumed the net proceeds received from this Transaction will be returned to shareholders by way of an on-market share buyback programme.

Tate & Lyle PLC's LEI number is: 2138008K14474WPKZ244

About KPS

KPS, through its affiliated management entities, is the manager of the KPS Funds, a family of investment funds with approximately $21.4 billion of assets under management (as of December 31, 2023). For over three decades, the Partners of KPS have worked exclusively to realise significant capital appreciation by making controlling equity investments in manufacturing and industrial companies across a diverse array of industries, including basic materials, branded consumer, healthcare and luxury products, automotive parts, capital equipment and general manufacturing. KPS creates value for its investors by working constructively with talented management teams to make businesses better and generates investment returns by structurally improving the strategic position, competitiveness and profitability of its portfolio companies, rather than primarily relying on financial leverage. The KPS Funds’ portfolio companies currently generate aggregate annual revenues of approximately $20.3 billion, operate 222 manufacturing facilities in 26 countries, and have approximately 48,000 employees, directly and through joint ventures worldwide (as of December 31, 2023). The KPS investment strategy and portfolio companies are described in detail at www.kpsfund.com.

Forward looking statements

This announcement may contain certain forward-looking statements, beliefs or opinions, including statements with respect to Tate & Lyle’s business, financial condition and results of operations. These forward-looking statements can be identified by the use of words such as “anticipate”, “expect”, “estimate”, “intend”, “will”, “may”, “project”, “plan”, “target” and “believe” and other words of similar meaning in connection with any discussion of future events. These statements, by their nature, involve risk, uncertainty and qualifications because they relate to events and depend upon circumstances that may or may not occur in the future. A number of factors could cause actual results and developments to differ materially from those expressed or implied by the forward-looking statements in this announcement and accordingly all such statements should be treated with caution. There can be no assurance that any particular forward-looking information will be realised, and the performance of Tate & Lyle may be materially and adversely different from the forward-looking statements. Except where otherwise stated, this announcement speaks as of the date hereof. Other than in accordance with its legal or regulatory obligations, Tate & Lyle is not under any obligation and Tate & Lyle expressly disclaims any intention or obligation (to the maximum extent permitted by law) to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

No statement in this announcement is intended as a profit forecast or estimate for any period and no statement in this announcement should be interpreted to mean that earnings or earnings per share or income, cash flow from operations or free cash flow for Tate & Lyle for the current or future financial years would necessarily match or exceed the historical published earnings or earnings per share or income, cash flow from operations or free cash flow for Tate & Lyle.

Certain figures contained in this announcement, including financial information, have been subject to rounding adjustments. Accordingly, in certain instances, the sum or percentage change of the numbers contained in this announcement may not conform exactly to the total figure given.

Cautionary Statements

This announcement is not intended to, and does not constitute or form part of, and should not be construed as, any offer, invitation, solicitation or recommendation of an offer to purchase, sell, subscribe for or otherwise dispose of or acquire any securities or the solicitation of any vote or approval in any jurisdiction and neither the issue of the information nor anything contained herein shall form the basis of or be relied upon in connection with, or act as an inducement to enter into, any investment activity. No shares are being offered to the public by means of this announcement. This announcement does not constitute either advice or a recommendation regarding any securities, or purport to contain all of the information that may be required to evaluate any investment in Tate & Lyle or any of its securities and should not be relied upon to form the basis of, or be relied on in connection with, any contract or commitment or investment decision whatsoever. Past performance is not an indication of future results and past performance should not be taken as a representation that trends or activities underlying past performance will continue in the future.

Important information in relation to advisors

Citigroup Global Markets Limited is acting as exclusive financial adviser to Tate & Lyle on the Transaction. Linklaters LLP is acting as legal advisor to Tate & Lyle on the Transaction.

Citigroup Global Markets Limited ("Citi"), which is authorised by the Prudential Regulation Authority (“PRA”) and regulated in the UK by the Financial Conduct Authority (“FCA”) and the PRA, is acting as the sole advisor for Tate & Lyle and for no one else in connection with the matters described in this announcement and will not be responsible to anyone other than Tate & Lyle for providing the protections afforded to clients of Citi nor for providing advice in connection with any other matters referred to in this announcement. Neither Citi nor any of its affiliates, directors or employees owes or accepts any duty, liability or responsibility whatsoever (whether direct or indirect, consequential, whether in contract, in tort, in delict, under statute or otherwise) to any person who is not a client of Citi in connection with this announcement, any statement contained herein or otherwise.

ENDS