Results for the year ended 31 March 2024

Strong profit and cash performance

Sale of remaining interest in Primient completes transformation to speciality business

Sale proceeds to be returned to shareholders through share buyback programme

Key highlights

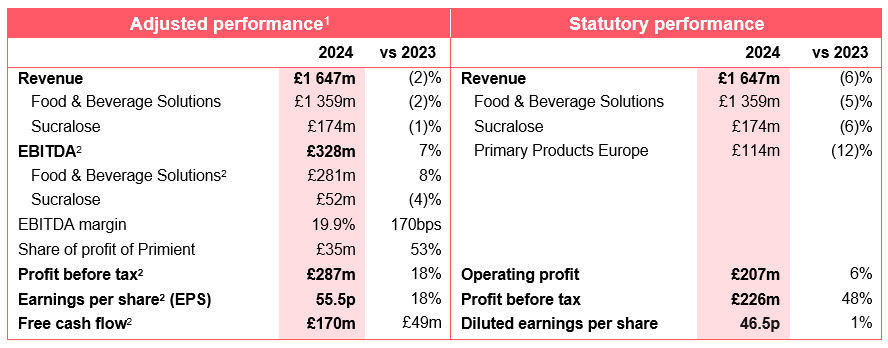

Strong financial performance, successfully navigating challenging markets

- Adjusted EBITDA growth +7%, adjusted EBITDA margin +170bps

- Excellent cash generation with cash conversion 23ppts higher at 85%, well ahead of target

- Strong productivity performance leads to increase in 5-year savings target to US$150m

Primient sale completes transformation to speciality food and beverage solutions business

- Agreed sale of remaining interest in Primient for US$350m in cash

- Intention to return net cash proceeds from Primient sale to shareholders via share buyback programme

Continue to progress growth-focused strategy and invest for long-term

- Solutions-based business increasing; solutions revenue from new business wins up 3ppts to 21%

- Continue to invest in innovation and solution selling, technology and new capacity

Leading in sustainability, with new, more ambitious climate targets aligned to 1.5oC trajectory

- New science-based GHG emissions targets to 2028 deliver larger, faster emissions reductions

Financial headlines

• Revenue (2)% due to lower volume from soft consumer demand, customer destocking and prioritising margin

• Adjusted EBITDA2 up 7%, benefiting from proactive mix management, productivity savings and cost discipline

• Strong productivity performance with savings of US$41m delivered in first year of five-year ambition

• Adjusted profit before tax up 18%, from FBS3 growth, increased Primient share of profit, lower finance charges

• Free cash flow1 of £170m, £49m higher driven by strong cash conversion from working capital discipline

• Organic return on capital employed1 improved by 40bps; on reported basis decreased 20bps to 17.4%

• Recommending final dividend of 12.9p per share: full-year dividend of 19.1p per share +3.2%

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Nick Hampton, Chief Executive said: “In challenging market conditions, it’s been another year of robust financial performance and strategic progress, with strong profit growth and productivity delivery, excellent cash generation, and further progress to transform the business.

The actions taken over the last six years have created a higher quality and more resilient business, with the agility to navigate the challenging economic environment and softer consumer demand we saw last year. While managing these short-term market dynamics, we also continued to set up the business for long-term growth by increasing investment in technology, innovation, solution selling and new capacity, and by intentionally moving away from low margin business. I am particularly pleased by our progress building our solutions business with customers, a core element of our strategy, with solutions new business wins continuing to grow.

The separate announcement we made today of the sale of our remaining stake in Primient represents an important milestone for our business. With this sale, the transformation of Tate & Lyle into a fully-focused speciality food and beverage solutions business is complete. We are now well-positioned to capture the significant growth opportunities ahead as we look to provide our customers with the solutions they need to meet growing consumer demand for healthier, tastier and more sustainable food and drink.

Our robust balance sheet, strong cash generation and the proceeds from the sale of Primient underpin our confidence to enhance shareholder returns through the share buyback programme, whilst retaining the flexibility to pursue both organic and inorganic growth opportunities. We are excited by Tate & Lyle’s future.”

Outlook

We have navigated the unprecedented cycle of inflation and volatile consumer demand well, delivering a compound average growth rate of revenue of 11% and adjusted EBITDA of 10% for the three years ended 31 March 2024.

Over the last year, we prioritised revenue and margin, ahead of volume growth. Looking ahead, we expect to grow from this new base and, with the end of customer destocking and consumer confidence gradually improving, we expect good volume growth in the 2025 financial year, accelerating as the year progresses.

Following a period of exceptional input cost inflation, we are now seeing input cost deflation and, as a result, revenue was lower in the second half of the 2024 financial year reflecting the pass through of lower costs. This is expected to continue in the first half of the 2025 financial year.

Therefore, for the year ending 31 March 2025, we expect to deliver in constant currency:

- Revenue slightly lower than the prior year

- EBITDA growth of between 4% and 7%.

Following completion of the sale of Primient, we will no longer consolidate its profits.

1. Revenue growth, adjusted EBITDA and adjusted EBITDA margin, share of adjusted profit of Primient, adjusted earnings per share, free cash flow, return on capital employed (ROCE), net debt and net debt to EBITDA are non-GAAP measures (see pages 11 to 14). Changes in adjusted performance metrics are in constant currency and for continuing operations. Organic ROCE excludes the impact of acquisitions.

2. Comparative restated to exclude other M&A costs of £(2) million reflecting the revised definition of adjusted EBITDA, see page 33.

3. FBS is Food & Beverage Solutions

ENDS

Webcast details

Following this statement’s release on 23 May 2024 at 07.00am (UK time), a live webcast will be held at 10.00am via this link. A replay of the webcast and presentation will be made available afterwards at this link. Only sell-side analysts and any pre-registered buy-side investors will be able to ask questions during the Q&A session. Sell-side analysts will be automatically pre-registered. To pre-register, please contact Lucy Huang at lucy.huang@tateandlyle.com.

For more information contact Tate & Lyle PLC:

Christopher Marsh, VP Investor Relations

Tel: Mobile: +44 (0) 7796 192 688

Nick Hasell, FTI Consulting (Media)

Tel: Mobile: +44 (0) 7825 523 383