Overview

Tate & Lyle delivered another quarter of solid operating performance, with volume and EBITDA growth and continued strong cash delivery. The acquisition of CP Kelco completed in November.

Trading

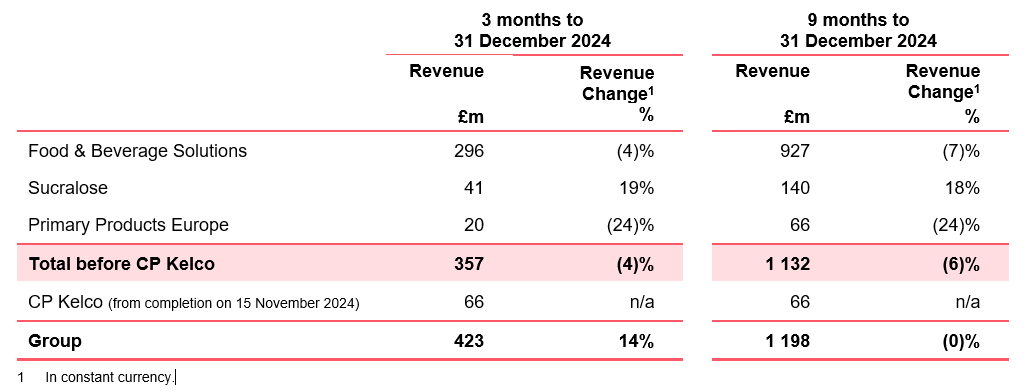

Volume in Food & Beverage Solutions was 4% higher, with growth in each region. Revenue was 4% lower primarily reflecting the pass through of input cost deflation. Sucralose performed strongly, benefiting from the continued impact of the pull-forward of customer orders which we expect will partly unwind in the fourth quarter.

We delivered further productivity savings during the quarter, with good progress against our five-year US$150 million productivity target.

CP Kelco performed in line with our expectations, delivering strong volume growth in the 2024 calendar year as well as delivering the anticipated progress on the phased margin recovery outlined at the time of the acquisition. The integration of CP Kelco, focused on our three priorities of ‘customers, people and performance’, is progressing to plan. The progress to-date reinforces our confidence in delivering the targeted run-rate cost synergies of US$50 million by the end of the 2027 financial year, as well as the identified revenue synergies over the medium term. We will operate as one business from 1 April 2025.

In line with the normal cycle of our industry, during the quarter we renewed contracts for the 2025 calendar year for those customers who contract annually. While market demand remains broadly stable, we have not yet seen the acceleration in demand we expected in the second half of the 2025 financial year. Against this background, continued geopolitical uncertainties and some pricing pressure, we renewed contracts for both Tate & Lyle and CP Kelco which are expected to deliver volume and revenue growth in the 2025 calendar year.

Balance sheet

Cash generation remained strong, with cash conversion consistent with our long-term ambition.

On 9 January 2025 we completed our £215 million on-market share buyback programme to return the net proceeds from the sale of our remaining interest in Primient to shareholders.

On 23 January 2025 we successfully priced a multi-tranche debt offering of US$300 million and

€275 million in the private placement market. The proceeds will be used to refinance the bridge facility entered into at the completion of the acquisition of CP Kelco and for general corporate purposes.

Outlook

For the year ending 31 March 2025, excluding CP Kelco and in constant currency, we now expect revenue to be mid-single digit percent lower and for EBITDA growth to be towards the lower end of our guidance range of 4% to 7%.

Financial results

Nick Hampton, Chief Executive, said:

“This was another quarter of good volume and EBITDA performance. Each region delivered volume growth, and we saw strong productivity and cash delivery. The muted consumer demand environment and ongoing geopolitical uncertainties reinforce the importance of the steps we have taken to reposition Tate & Lyle over the last six years. In this environment, we remain focused on delivering profitable volume growth through stronger solutions-based relationships with customers, delivering productivity savings and strong cash flow.

We also made excellent strategic progress in the quarter with the completion of the acquisition of

CP Kelco, a leading global pectin and speciality gums business. This acquisition represents a significant acceleration in the delivery of our growth-focused strategy and establishes Tate & Lyle as a leader in Mouthfeel, while strengthening expertise across our Sweetening and Fortification platforms. Mouthfeel is a critical driver of customer solutions, and we are encouraged by the positive response of customers to the benefits of our expanded portfolio and solutions capabilities.

I want to recognise colleagues across Tate & Lyle and CP Kelco for their unrelenting focus on bringing our two great businesses together. This combination significantly strengthens our customer offering, expands our reformulation capabilities, and further increases our ability to benefit from structural long-term trends towards healthier, tastier and more sustainable food and drink."

END

Conference call

The third quarter conference call will be held today at 10.00am GMT hosted by Nick Hampton, Chief Executive and Sarah Kuijlaars, Chief Financial Officer. Participants are requested to dial in at least 10 minutes before the start of the call. Dial in details are as follows:

UK dial in number: +44 (0)33 0551 0200

UK toll free number: 0808 109 0700

US dial in number: +1 786 697 3501

US toll free number: +1 866 580 3963

Password: Tate & Lyle

14 day conference call replay:

UK replay number: +44 (0)20 8196 1480

UK toll free replay number: 0800 640 6344

US toll free replay number: +1 866 583 1035

Access pin: 7481245#

For more information contact Tate & Lyle PLC:

Christopher Marsh, VP, Investor Relations

Mobile: +44 (0)7796 192 688

Nick Hasell (FTI Consulting), Media Relations

Mobile: +44 (0)7825 523 383