Results for the year ended 31 March 2023

FULL-YEAR HIGHLIGHTS

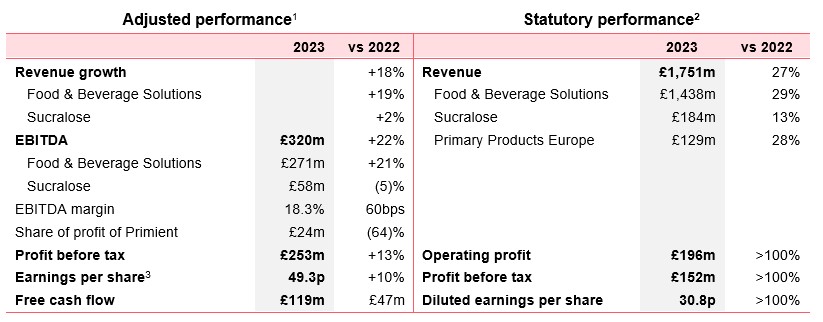

Group: Strong financial performance across all key measures

- Revenue growth +18%: +19% in Food & Beverage Solutions (FBS)

- Adjusted EBITDA +22%: inflation offset by mix management, pricing, productivity savings and cost discipline

- Adjusted profit before tax +13%: strong FBS performance and materially lower profits from Primient

- Return on capital employed of 17.5%, improved by 100 bps • Free cash flow1 £119m, £47m higher reflecting strong cash conversion

- Strong balance sheet supports investment in growth, net debt to EBITDA ratio 0.7x

- Recommending increase in final dividend of 2.5% to 13.1p per share; full-year dividend of 18.5p per share

Science: Innovation continues to deliver with investment accelerating to support future growth

- New Product revenue growth +17% with strong growth in mouthfeel and fortification platforms

- New Product revenue as a percentage of Food & Beverage Solutions revenue at 17%

- Investment in innovation and solutions selling increased by 11%

Solutions: Building deeper solutions-based relationships with customers

- Solutions new business wins by value up 2ppts to 18% of pipeline

- Strengthened solutions offering with acquisitions of Quantum (dietary fibre) and Nutriati (chickpea protein)

- Expanded consumer and category insights expertise in North America, Asia and Latin America

Society: Good progress on purpose and sustainability targets

- 6% reduction in Scope 1 & 2 GHG emissions and 13% in Scope 3 emissions4; 92% of waste beneficially used

- Sustainable agriculture programmes for corn and stevia delivering material environmental improvements

- Target to provide 3 million4 meals through food bank partnerships met two years ahead of schedule

Nick Hampton, Chief Executive said:

“It has been an excellent first year for the new Tate & Lyle with strong financial performance and significant strategic progress.

Our key financial measures were all met, with Group revenue and adjusted EBITDA showing double-digit growth and productivity savings well ahead of target. It’s also been another year of strategic progress as we further improved the mix of the business, greatly strengthened our solution selling capabilities, acquired a high-quality dietary fibre business in China, made a commitment to reach net zero by 2050 and launched our new brand to better reflect the new Tate & Lyle.

Tate & Lyle’s expertise in sweetening, mouthfeel and fortification plays directly into increasing consumer demand for food and drink which is healthy, tasty, convenient, and more sustainable and affordable. The growth opportunity ahead is substantial and we saw encouraging progress in the year with revenue from New Products and solutions wins both demonstrating good momentum.

The re-positioning of Tate & Lyle continues at pace. With our clear strategic focus and strong scientific and solutions capabilities, we are well-placed to progress our strategy and deliver on the five-year financial growth ambition announced in our Capital Markets Event in February 2023.”

OUTLOOK

For the year ending 31 March 2024, we expect to deliver progress in line with our five-year ambition to 31 March 2028 with, in constant currency:

- Revenue growth of 4% to 6%

- Adjusted EBITDA growth of 7% to 9%.

We also expect stronger profits from our minority holding in Primient.

1. Revenue growth, adjusted EBITDA and adjusted EBITDA margin, share of adjusted profit of Primient, adjusted earnings per share, free cash flow, return on capital employed (ROCE), net debt and net debt to EBITDA are non-GAAP measures (see pages 8 to 11). Changes in adjusted performance metrics are in constant currency and for continuing operations. Comparatives for adjusted performance are pro-forma financial information (see Additional Information)

2. Continuing operations.

3. Adjusted EPS calculated using the shares in issue adjusted for impact of the 6 for 7 share consolidation as if it occurred on 1 April 2021.

4. From baseline of 31 December 2019 for GHG emissions; baseline of 31 March 2020 for meal donations.

ENDS

Webcast details

Following this statement’s release on 25 May 2023 at 07.00am (UK time), a live webcast will be held at 10.00am, via this link. A replay of the webcast and presentation will be made available afterwards at https://tateandlyle-events.com/year-ended-2023. Only sell-side analysts and any pre-registered buy-side investors will be able to ask questions during the Q&A session. Sell-side analysts will be automatically pre-registered. To pre-register, please contact Lucy Huang at lucy.huang@tateandlyle.com.

For more information contact Tate & Lyle PLC:

Christopher Marsh, VP Investor Relations

Tel: Mobile: +44 (0) 7796 192 688

Nick Hasell, FTI Consulting (Media)

Tel: Mobile: +44 (0) 7825 523 383